Credit Health

About

How I designed a group chat feature that transformed a retention issue into a closely-knit community.

Client

Boyd Creative Australia Pty Ltd

Year & duration

2025

-

6 months (ongoing)

Role

Overview

Long:

We brought Credit Card Compare back to the original .com.au, but over time, card applications dropped while bounce rates increased. My hypothesis was that the landscape has shifted—people now have less patience for long reads and get easily overwhelmed by too many offers at once, expecting quick answers to specific questions. If that’s true, then too many steps, excessive information, and no instant answers are driving people away.

How I Arrived at the Solution

UX Strategy

Built & Delivered

Long:

Artifacts: Information architecture, user journey maps, decision logic flows and wireframes for the Credit Card Matchmaker and side-by-side comparison (with content specifications), UX microcopy and content guidelines, trust-building articles, design system tokens and components, interactive prototypes, and annotated handoff specs.

Execution & iteration:

I reduced Matchmaker from 10 to 6–8 steps after testing, prioritizing the highest-impact narrowing signals.

I validated an up-to-8-card compare cap to balance choice with cognitive load.

I defined a biweekly A/B plan on copy and microcopy to lift confidence and reduce bouncing. I tuned AI-chat prompts using real user queries to improve relevance and cut fallback rates.

Collaboration & handoff: I worked with frontend, backend, and leadership to deliver interaction specifications, design tokens, content guidelines, and acceptance criteria, plus comprehensive coverage of states and edge cases for all features.

Instrumentation: I defined tracking events for wizard start/complete, shortlist shown, compare add/remove, product viewed, chat open/resolved, calculator open/return, and “Apply now” clicks.

Status: Frontend and backend implementation is underway based on these specs; I’ll share results once live.

What I Chose & Why

Long:

To reduce cognitive load, I designed Credit Card Matchmaker—initially a 10-question wizard that uses AI to deliver a curated shortlist from over 200 cards. The questions cover usage patterns, priorities, fee tolerance, and issuer preferences, guiding users efficiently to relevant options.

To make comparing cards easier, I redesigned the side-by-side comparison to clearly showcase key differences in rates, fees, and rewards, alongside straightforward eligibility information, making it easy for users to evaluate cards at a glance.

To answer unique user questions, I added an on-page AI chat feature trained on our structured card data and FAQs, so users can ask situational questions (e.g., “Can I balance transfer AUD 20,000 and still earn points?”) and get plain English answers without leaving the page.

To build trust and credibility, I added third-party reviews, licensing information, and a concise “how we make money” explainer, plus simple application guides—making transparency obvious where decisions happen.

To measure and iterate, I defined the tracking spec for core metrics (time to shortlist, question-resolution rate, confidence score, apply click-through rate, and bounce rates) and planned biweekly A/B tests on copy, layout, and trust elements—using data and ongoing user feedback to guide each improvement cycle.

User & Business Impact

Long:

Early signals:

Completion time: 45-second average for Credit Card Matchmaker (goal < 60s).

Answers on page: 90% of scenario questions resolved without human support.

Confidence: 80% of participants reported feeling ready to apply after comparing.

Ease of use: 100% of participants found these new features helpful, and would recommend the site once it’s live.

What I’ll track post-launch:

Increase in “Apply now” CTR.

Higher approval rates.

Lower bounce rates.

Increase organic traffic.

Learnings & Next Steps

Long:

Prototype results proved that guiding users through a set of focused questions and then presenting cards outperforms normal filtering.

Microcopy proved crucial: even really small changes like labeling the primary action “Apply now” drove more engagement than the generic “Application” button.

AI-driven chat demonstrated its potential for on-demand support, resolving 90% of scenario questions without human assistance—clearly the future for credit comparison sites.

Establishing a design system paid dividends: it ensured consistency across this project and can be repurposed for our sister site Finty with different branding and audiences.

Next Steps:

Test the solution in a live environment to gather real user behavior and feedback for iteration.

Further refine question sequencing using analytics to have the highest-impact possible.

Introduce an AI-powered chat available on all pages that lets users simply describe what they’re looking for and receive a personalized set of card matches as part of the Matchmaker experience.

Supporting Visuals

Logo presentation

Logo usage

Logo variations

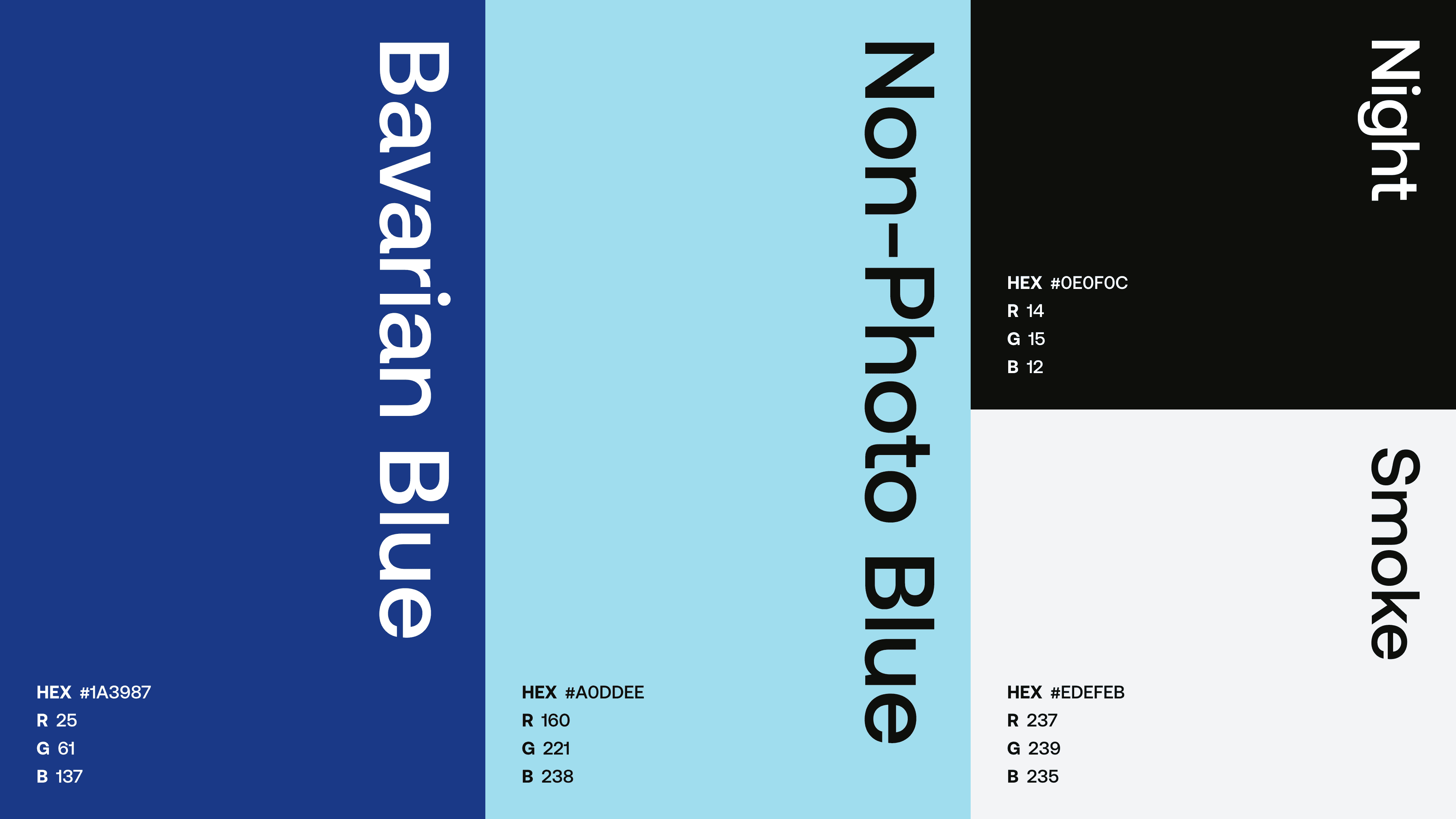

Color palette

Typography

Typography details

Brandmark & icons

Browser icon

Grid system